Understanding Japan’s Negative Interest Rate Policy

Japan’s journey with negative interest rates marks a significant chapter in the annals of global economic policy. This daring maneuver, aimed at combating deflation and stimulating economic growth, has ignited discussions among economists, policymakers, and investors worldwide. Through a detailed exploration, this article sheds light on the genesis, impacts, and future implications of Japan’s negative interest rate policy.

The Genesis of Negative Interest Rates in Japan

The decision to adopt negative interest rates in Japan was not made overnight. Faced with prolonged economic stagnation and deflationary pressures, the Bank of Japan (BOJ) embarked on this unconventional path in January 2016. This policy was intended to encourage banks to lend more by penalizing them for holding excess reserves, thereby stimulating investment and spending.

Objectives Behind the Negative Interest Rate

The primary goal was to break the cycle of deflation, stimulate borrowing, and invigorate the economy. By reducing the cost of borrowing, the BOJ aimed to foster a more dynamic economic environment conducive to growth and inflation.

How Negative Interest Rates Work

Negative interest rates invert the traditional banking model, charging financial institutions for holding funds with the central bank. This encourages banks to lend more aggressively, thereby increasing money flow into the economy.

The Impact of Negative Interest Rates on the Economy

Effects on Banks and Financial Institutions

Initially, negative rates squeezed the profit margins of banks, leading to concerns about the long-term health of the financial sector. However, over time, adaptations in lending practices helped mitigate some of these challenges.

Influence on Consumers and Businesses

For consumers and businesses, the lower borrowing costs sparked an increase in loans and investments. Yet, the expected surge in spending was more muted, as uncertainty led to increased savings.

Japan’s Economic Environment Post-Negative Interest Rates

Despite these measures, Japan’s economic growth and inflation have remained tepid. The yen’s performance has been mixed, reflecting the complex interplay between domestic policy and global economic conditions.

Comparing Japan’s Strategy with Other Countries

Globally, several other countries have experimented with negative rates. Japan’s experience offers valuable lessons on the potential benefits and pitfalls of this unconventional policy.

The Future Outlook of Japan’s Negative Interest Rate Policy

Looking ahead, experts remain divided on the long-term efficacy of negative rates. Adjustments and policy shifts may be necessary as Japan navigates its economic future.

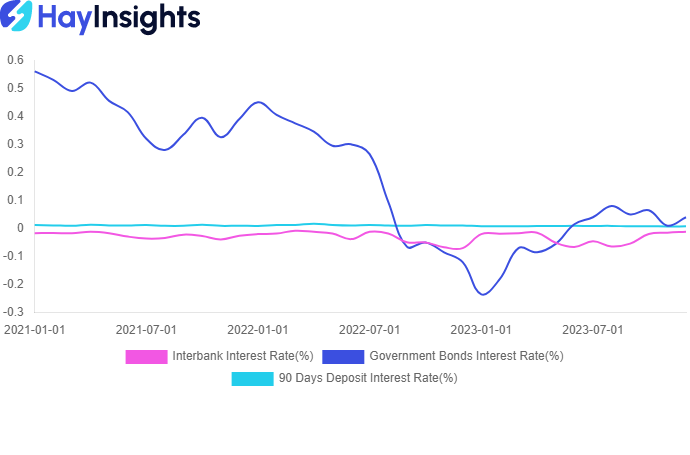

To follow and monitor the interest rates, visit HayInsights, an AI-powered, report-ready financial data hub that provides top-down data for financial analysis. Interest rates and other indicators are visualized on the platform, making it easy to understand, track, and monitor.

The Genesis of Negative Interest Rates in Japan

Embarking on the path of negative interest rates was a calculated decision by the Bank of Japan (BOJ) to stimulate an economy that had been languishing in deflation for decades. This policy, unconventional at its core, aimed to encourage banks to increase lending and stimulate economic activity by effectively charging them for holding excess reserves. The backdrop of this policy was a stagnating economy, with traditional monetary policy tools having reached their limits. Japan’s bold move was watched closely by economies worldwide, serving as a case study in innovative economic policy.

Objectives Behind the Negative Interest Rate

The BOJ’s primary aim was to reinvigorate the economy by encouraging spending and investment. By making borrowing cheaper, it hoped to discourage savings and stimulate demand. This was seen as a crucial step towards reversing the deflationary spiral, characterized by falling prices and a reluctance to spend, which had hampered Japan’s economic growth for years.

How Negative Interest Rates Work

The mechanics of negative interest rates are counterintuitive to the traditional banking model, where savers earn interest and borrowers pay interest. Under this policy, the central bank charges financial institutions to keep their excess reserves, encouraging them to lend more to businesses and consumers. The rationale is that increased lending will lead to more spending and investment, thereby stimulating economic growth and inflation.

The Impact of Negative Interest Rates on the Economy

Effects on Banks and Financial Institutions

The introduction of negative interest rates had a profound impact on Japan’s banking sector. Initially, there were concerns about profitability as the margins on loans narrowed. Over time, however, financial institutions adjusted by diversifying their income sources and enhancing efficiency in operations. Despite these adjustments, the long-term sustainability of these measures remains a subject of debate among financial analysts.

Influence on Consumers and Businesses

For consumers, the lower borrowing costs did lead to an uptick in loans, particularly in sectors like housing and personal finance. Businesses, especially small and medium-sized enterprises, benefited from cheaper credit, facilitating investment in expansion and innovation. However, the anticipated surge in consumer spending did not materialize to the extent expected, as a cautious outlook led many to save rather than spend.

Japan’s Economic Environment Post-Negative Interest Rates

In the years following the adoption of negative interest rates, Japan’s economy has shown signs of recovery, albeit at a slower pace than hoped. Economic growth has been modest, and inflation rates have remained below the BOJ’s target. The policy’s impact on the yen has been mixed, influencing Japan’s export competitiveness and the import cost of goods.

Comparing Japan’s Strategy with Other Countries

The use of negative interest rates is not unique to Japan. Countries such as Switzerland, Denmark, and Sweden have also adopted similar policies with varying degrees of success. Each country’s experience provides valuable insights into the complexities of managing an economy in a low-interest-rate environment. Japan’s approach, characterized by its combination with other monetary easing measures, offers a unique perspective on the potential and limits of negative rates.

The Future Outlook of Japan’s Negative Interest Rate Policy

The debate on the future of negative interest rates in Japan continues among economists and policymakers. Some advocate for a gradual phase-out, arguing that the economy needs to transition to a more traditional interest rate environment. Others believe that negative rates may need to remain in place longer to ensure sustained economic growth and achieve inflation targets. The BOJ’s future policy directions will be closely watched, as they will have significant implications not only for Japan but for the global economy.

Conclusion: Evaluating the Effectiveness of Negative Interest Rates

Japan’s experiment with negative interest rates offers crucial lessons on the use of unconventional monetary policy tools. While it has spurred some economic activity, the full realization of its objectives remains a work in progress. The effectiveness of negative interest rates continues to be a subject of global interest, with Japan’s experience providing key insights into the challenges and opportunities presented by such policies. As we look to the future, the evolution of Japan’s economic policy will undoubtedly contribute to the ongoing debate on how best to achieve sustainable economic growth in a low-interest-rate world.