Understanding the Consumer Price Index (CPI)

The Consumer Price Index (CPI) serves as a critical barometer for assessing inflation and living cost changes over time. By measuring the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, CPI provides invaluable insights into the economic health and consumer purchasing power within an economy. This article delves into the concept of CPI, its operational mechanisms, and its profound implications on the Japanese economy, underpinning major macroeconomic policies and movements in the stock market.

Definition and Functioning of CPI

CPI represents more than just a statistical figure; it’s a lens through which the economic stability and inflationary trends of a nation are viewed. In Japan, a country with a dynamic and highly sophisticated economy, understanding CPI is pivotal for both policymakers and investors. The process involves selecting a representative basket of goods and services, tracking price changes over time, and analyzing these changes to gauge the overall economic health.

To view Japan’s CPI, visit HayInsights, an AI-powered, comprehensive financial data hub, specializing in the Japanese market.

CPI’s Macro and Microeconomic Significance

In the macroeconomic landscape, CPI is indispensable for adjusting income payments, guiding monetary policy, and framing fiscal policies. For individuals and businesses, CPI data can influence decisions related to investments, savings, and spending, showcasing its broad spectrum of impact.

CPI and the Japanese Economy

The Japanese economy‘s unique characteristics, including its period of deflationary pressure and rapid technological advancement, make CPI an essential tool for economic assessment. Historical trends in Japan’s CPI have direct correlations with policy adjustments, consumer confidence, and international economic competitiveness.

Financial Implications and Strategic Planning

For investors and the financial sector, CPI data is a cornerstone for making informed decisions. The relationship between CPI, consumer behavior, and the stock market in Japan highlights the importance of understanding inflationary trends for portfolio management and investment strategies.

Global Context and Future Outlook

Comparing CPI trends between Japan and other major economies offers insights into global economic health and potential areas for policy synchronization. Future projections for Japan’s CPI are crucial for anticipating economic shifts, with technological innovations promising to refine data accuracy and usefulness.

Analyzing CPI Data for Financial Planning

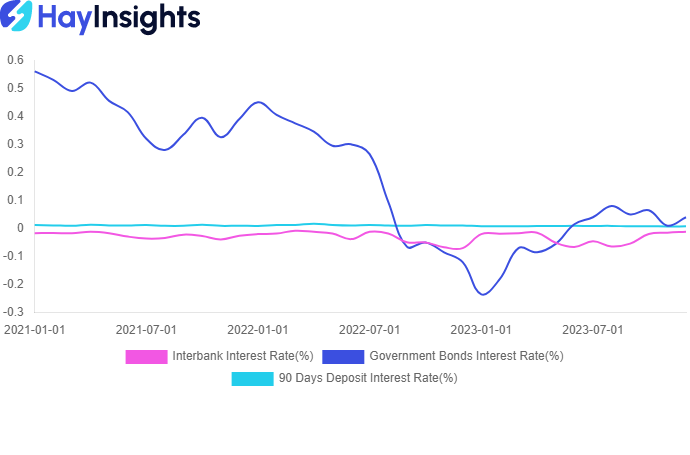

For investors, understanding the CPI is crucial as it directly affects investment returns and market dynamics. CPI as a Tool for Investors provides insights into the potential inflation trends which can erode or enhance real investment returns. For example, a rising CPI often prompts the Bank of Japan to adjust interest rates, which in turn influences bond yields and stock prices. In the context of the Stock Market, inflationary expectations can lead to volatility, as investors adjust their portfolios in anticipation of higher rates, influencing sectors like real estate and consumer goods differently.

Moreover, Consumer Spending Behavior is significantly influenced by CPI data. In Japan, where consumer spending constitutes a large portion of GDP, fluctuations in CPI affect consumer confidence and spending patterns. For instance, an unexpected rise in CPI might lead consumers to tighten their spending if they feel that their income does not keep pace with inflation, affecting retail and consumer services sectors.

Global Comparisons and Japan’s Position

When analyzing CPI Trends in Japan vs. Other Economies, it’s evident that Japan has experienced unique challenges, such as deflationary periods not commonly seen in Western economies. This aspect necessitates different policy responses, highlighting Japan’s distinctive economic structure. Furthermore, Japan’s approach to overcoming these challenges provides a valuable case study for other nations grappling with similar issues.

Japan’s Unique Economic Structure and CPI also reflects how demographic factors, like an aging population, influence CPI. An aging demographic impacts consumer preferences and alters spending habits, which in turn affects the CPI calculation and its implications for the economy.

Future Projections: CPI and the Japanese Economy

Looking forward, Predicting Economic Health with CPI involves examining current and historical CPI data to forecast economic conditions. Economists and policymakers scrutinize these projections to adjust monetary and fiscal policies accordingly.

Potential Challenges and Opportunities arise as Japan navigates economic recovery and growth. For instance, innovations in technology and shifts in global trade could either pose challenges or create opportunities that impact CPI and economic strategies.

Lastly, the Innovations in Measuring CPI section points towards advancements such as digital data collection and real-time analytics that could enhance the accuracy and relevance of CPI measurements. These innovations are pivotal in adapting economic policies to the rapidly changing global economic landscape.

Conclusion

The Consumer Price Index is an indispensable tool in macroeconomic policy formulation in Japan, influencing everything from monetary policy to individual financial decisions. As Japan continues to adapt to both internal and global economic pressures, the role of CPI in economic strategy remains critically important. For policymakers, investors, and consumers alike, staying informed about CPI trends is essential for navigating the complexities of the economy effectively.