Navigating Negative Interest Rates in Japan

Interest rates are a fundamental aspect of any economy, acting as the price of borrowing money. They influence every corner of financial activities, from the decisions of central banks to the savings and investments of the general public. However, when countries like Japan venture into the realm of negative interest rates, it prompts a global curiosity about the rationale and implications of such a policy. This article delves into the concept of negative interest rates, explores why some countries have adopted them, and examines their impact on economies, with a focus on Japan.

The Basics of Interest Rates

Interest rates, essentially the cost of borrowing money, play a pivotal role in regulating an economy‘s growth. They influence consumer spending, inflation, and investment strategies. However, when traditional monetary policies lose their effectiveness, some countries resort to negative interest rates as a radical measure to stimulate economic activity.

Diving into Negative Interest Rates: An Overview

Negative interest rates turn the conventional concept of interest on its head. Instead of receiving interest on savings, depositors pay the bank to hold their money. This unconventional approach is primarily adopted to encourage spending and investment over saving, in hopes of reviving economic growth.

The Global Perspective on Negative Interest Rates

Negative interest rates are not a universal fix but a targeted strategy reflecting a country’s unique economic challenges. They are often seen as a last resort to combat deflationary pressures, encourage lending, and stimulate economic activity.

The Economic Impact and Public Reaction to Negative Interest Rates

The introduction of negative interest rates has a profound impact on an economy. It affects everything from the banking sector’s profitability to the investment landscape and consumer behavior. Public reaction can be mixed, as the benefits of increased spending and investment opportunities are weighed against the downsides of reduced income from savings.

Japan’s Strategy: Embracing Negative Interest Rates

Japan’s decision to adopt negative interest rates is rooted in its prolonged battle with deflation and sluggish economic growth. By charging banks for holding excess reserves, the Bank of Japan aims to encourage lending, hoping to spur inflation and economic activity.

Evaluating the Impact of Negative Rates on Japan’s Economy

The impact of negative interest rates on Japan’s economy has been significant. While it has led to increased lending and some inflationary pressures, the policy’s effectiveness in achieving sustained economic growth and hitting inflation targets remains a subject of debate.

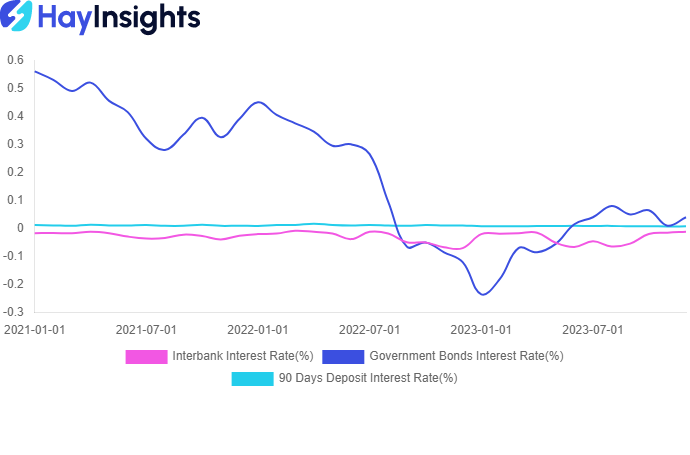

For more information on how interest rates are performing in consideration of other economic factors, visit HayInsights for a quick recap. HayInsights is an AI-powered financial data hub that provides visualized data for top-down analysis.

The Influence of Negative Interest Rates on Japan’s Economy

Negative interest rates in Japan have influenced various economic aspects, from altering the investment landscape to impacting consumer behavior and savings patterns. The policy aims to discourage hoarding money, thereby stimulating spending and investment.

Effects on Savings, Investments, and Consumer Spending

The introduction of negative interest rates aimed to shift the Japanese public’s preference from saving to spending and investing. However, the response has been varied, with some choosing to invest in higher-yield assets, while others remain hesitant to spend.

The Future of Interest Rates in Japan

Starting from March 2024, Japan has decided to lift its negative rates to between zero and 0.1%. Gradually, the Bank of Japan (BOJ) will continue to increase interest rates instead of prolonging the negative rates situation. This is a long-term plan and interest rates are expected to increase slowly and steadily, allowing other factors in the economy time to adjust.

Adjustments and Alternatives for Japan’s Economic Strategy

The Japanese government and the Bank of Japan may need to explore additional measures to complement or eventually replace negative interest rates, considering the complex dynamics of global economics and domestic challenges.

Negative Interest Rates: A Global Experiment with Local Nuances

Japan’s experience with negative interest rates provides valuable insights into the complexities of implementing such a policy. It highlights the need for a nuanced understanding of local economic conditions when adopting unconventional monetary strategies.

Conclusion: Navigating the Complex World of Negative Interest Rates

Japan’s venture into negative interest rates is a bold experiment in economic policy-making. While it offers a unique solution to persistent economic challenges, its long-term efficacy and impact remain closely monitored. As countries around the world watch and learn from Japan’s experience, the journey of negative interest rates continues to unfold, offering lessons on the complexities of modern economies.