What is a Balance Sheet? A Detailed Guide to Mastering The Most Essential Financial Statement 2025

What is a balance sheet? An overview

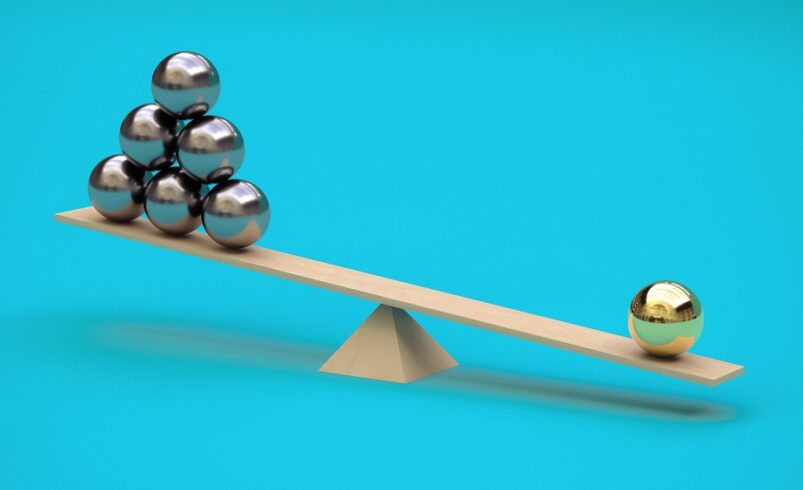

What is a balance sheet? It is one of the most fundamental financial statements, providing a snapshot of a company’s financial health at a specific point in time. It is a vital tool for business owners, investors, creditors, and analysts who need to understand a company’s financial position. The core principle behind a balance sheet is the fundamental accounting equation: Assets = Liabilities + Owner’s Equity. This equation ensures that the document is always “in balance,” reflecting the fact that all a company’s resources (assets) are financed either by borrowing (liabilities) or by the owners’ investments (owner’s equity). A clear understanding of this statement is crucial for making informed business decisions, assessing financial stability, and evaluating investment opportunities. Without it, it would be impossible to get a comprehensive view of a company’s financial standing, making it a cornerstone of both business management and financial analysis.

A balance sheet’s primary purpose is to provide a comprehensive overview of what a company owns, what it owes, and what is left over for its owners. This information is critical for various stakeholders. For instance, a potential investor might use it to assess the company’s capital structure and determine if it has a healthy mix of debt and equity. A bank, on the other hand, would analyze the balance sheet to evaluate the company’s ability to repay a loan. From a management perspective, the statement helps in strategic planning, such as deciding whether to invest in new assets or pay down existing debt. It is a foundational document that, when analyzed alongside the income statement and cash flow statement, provides a complete picture of a company’s financial performance and position.

The Three Pillars of a Balance Sheet: Assets, Liabilities, and Owner’s Equity

To truly understand what a balance sheet is, one must first grasp its three core components: assets, liabilities, and owner’s equity. Each of these components provides a distinct piece of the financial puzzle, and together, they form the complete picture of a company’s financial health.

Assets: What a Company Owns

Assets are anything of economic value that a company owns and uses to operate its business. They are typically listed on the balance sheet in order of liquidity—that is, how quickly they can be converted into cash. Assets are generally divided into two main categories: current assets and non-current (or long-term) assets.

Current Assets are those expected to be converted into cash within one year. They represent the company’s short-term resources and are essential for day-to-day operations. Examples include:

- Cash and Cash Equivalents: The most liquid assets, including physical cash, bank balances, and highly liquid short-term investments.

- Accounts Receivable: Money owed to the company by its customers for goods or services delivered on credit.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid Expenses: Payments made in advance for goods or services that will be used in the future, such as insurance premiums or rent.

- Non-Current Assets, also known as long-term assets, are not expected to be converted into cash within one year. They are typically used for a company’s long-term operations and are crucial for generating revenue over many years. Examples include:

- Property, Plant, and Equipment (PP&E): Tangible assets like land, buildings, machinery, and vehicles. These are often the largest assets for manufacturing companies.

- Intangible Assets: Non-physical assets that have economic value, such as patents, copyrights, trademarks, and goodwill.

- Long-Term Investments: Investments in other companies or securities that are not intended to be sold within a year.

Liabilities: What a Company Owes

Liabilities represent a company’s financial obligations to outside parties. Like assets, they are categorized based on their due date: current liabilities and non-current liabilities.

Current Liabilities are obligations that are due within one year. These are crucial for a company’s short-term liquidity and its ability to meet its immediate financial obligations. Examples include:

- Accounts Payable: Money the company owes to its suppliers for goods or services purchased on credit.

- Short-Term Loans: Debt with a maturity of less than one year.

- Accrued Expenses: Expenses that have been incurred but not yet paid, such as salaries and wages, or taxes.

- Non-Current Liabilities are long-term obligations that are not due for at least one year. These often represent significant sources of financing for a company’s long-term growth and capital expenditures. Examples include:

- Long-Term Debt: Loans or bonds with a maturity of more than one year.

- Deferred Tax Liabilities: Taxes that are owed but not expected to be paid within the next year.

Owner’s Equity: The Owners’ Stake

Owner’s equity, also known as shareholders’ equity for a public company, represents the residual interest in the company’s assets after all liabilities have been paid. It is essentially the amount of money that would be returned to the owners if all assets were sold and all liabilities were paid off. It reflects both the initial investment made by the owners and the accumulated profits that the company has retained over time. The two main components of owner’s equity are:

- Contributed Capital: The money owners or shareholders have directly invested in the company, typically through the sale of stock.

- Retained Earnings: The cumulative profits of the company that have been reinvested in the business rather than paid out as dividends to shareholders.

The Role of a Balance Sheet in Financial Analysis

A balance sheet is not a static document; it’s a dynamic tool that, when analyzed properly, can reveal a great deal about a company’s financial health. Analysts and investors often use various ratios derived from the balance sheet to evaluate a company’s liquidity, solvency, and efficiency.

- Liquidity Ratios: These measure a company’s ability to meet its short-term obligations. A common example is the Current Ratio, calculated by dividing current assets by current liabilities. A higher ratio generally indicates a stronger ability to pay off short-term debts.

- Solvency Ratios: These assess a company’s ability to meet its long-term debt obligations. The Debt-to-Equity Ratio is a key solvency metric, which compares a company’s total liabilities to its total owner’s equity. It provides insight into how much of the company’s operations are financed by debt versus equity.

- Efficiency Ratios: These measure how effectively a company is using its assets. The Asset Turnover Ratio, for example, measures how much revenue a company generates for every dollar of assets it owns.

A Japanese Example: Understanding a Balance Sheet through Nintendo Co., Ltd.

To put this all into a real-world context, let’s consider the balance sheet of a well-known Japanese company, Nintendo Co., Ltd. As an iconic company in the global video game industry, its balance sheet would reflect its unique business model.

On the assets side, Nintendo would have significant current assets, including a large amount of cash and cash equivalents, which is typical for a profitable tech company. They would also have a substantial inventory of gaming consoles (like the Switch), physical games, and accessories. Their non-current assets would include their corporate headquarters in Kyoto, Japan, and other properties, as well as the manufacturing equipment used to produce their products. Furthermore, their brand recognition and intellectual property (IP), such as characters like Mario and Zelda, are valuable intangible assets, although the value of these may not always be fully reflected on the balance sheet.

On the liabilities side, Nintendo would have current liabilities like accounts payable to suppliers who provide components for their consoles. They might also have short-term loans or other accrued expenses. Their non-current liabilities would likely be minimal, as the company has historically maintained a very strong financial position with little reliance on long-term debt. This is a common characteristic of financially robust Japanese companies.

Finally, in owner’s equity, a large portion would be retained earnings. This reflects decades of profitability and a conservative financial strategy where profits are often reinvested back into the company to fund research and development, as well as new game titles and hardware. The shareholders’ equity section would show the initial capital invested by shareholders and the accumulated profits, which is a testament to the company’s long-term success and strategic management. By examining Nintendo’s balance sheet, investors can see its strong liquidity, low debt, and vast reserves of cash, which are all indicators of a financially sound and well-managed company.

The Importance of the Balance Sheet in a Broader Context

The balance sheet is far more than just a list of numbers; it’s a narrative of a company’s financial history and its current financial health. When a balance sheet is analyzed in conjunction with the income statement and cash flow statement, it provides a powerful set of tools for financial analysis. The income statement shows the company’s profitability over a period, while the cash flow statement details how cash is moving in and out of the business. The balance sheet, in turn, provides the context by showing the financial position at a specific moment in time.

For example, a company might report a large profit on its income statement, but a closer look at its balance sheet might reveal a high level of accounts receivable, meaning a lot of that profit hasn’t been collected in cash yet. This could lead to a liquidity problem. Conversely, a company might show a loss on its income statement but have a strong balance sheet with a large cash reserve, indicating it is well-positioned to weather a temporary downturn. The interconnectedness of these three statements makes them essential for anyone seeking a complete financial picture of an organization. In essence, the balance sheet tells you “where the money is” and “who has claims to it” at a particular moment.

How to Read a Balance Sheet: A Step-by-Step Guide

Reading a balance sheet can seem intimidating at first, but with a structured approach, it becomes much more manageable. Here’s a simple guide to help you navigate this important financial document:

- Start with the Accounting Equation: Always remember that Assets = Liabilities + Owner’s Equity. This is your anchor. The two sides of the balance sheet must always match.

- Analyze Assets: Look at the total assets and then break them down into current and non-current. Pay attention to the composition of assets. A company with a lot of cash and little inventory is different from one with a lot of inventory and little cash.

- Examine Liabilities: Next, look at the liabilities section. Again, differentiate between current and non-current liabilities. A company with a high level of short-term debt might face liquidity issues, while a company with a high level of long-term debt might be heavily leveraged.

- Review Owner’s Equity: The equity section reveals the owners’ stake in the company. Look at the proportion of retained earnings to contributed capital. A high level of retained earnings suggests a company has been profitable and has a strong financial foundation.

- Calculate Ratios: Once you have a handle on the components, use the numbers to calculate key financial ratios. This will help you benchmark the company against its competitors and industry averages. For instance, comparing the current ratio of two competing companies can reveal which one is in a better position to handle short-term financial pressures.

- Compare Period-over-Period: The true power of a balance sheet comes from comparing it to previous periods. Did the company’s cash increase or decrease? Did its debt levels go up or down? This trend analysis provides crucial insights into a company’s financial trajectory.

- Integrate with Other Statements: Never analyze the balance sheet in isolation. Use the information from the income statement and cash flow statement to create a complete and holistic view of the company’s financial performance.

In conclusion, understanding ‘what is a balance sheet?’ is essential for anyone involved in finance or business. It is the cornerstone of financial analysis, providing a clear and organized picture of a company’s financial position at a given time. By carefully examining a balance sheet’s assets, liabilities, and owner’s equity, one can gain valuable insights into a company’s financial health, stability, and potential for future growth.