Nikkei 225 Explosive Gains: Explaining the Mid-August Peak

. 日経平均株価は好不調に推移しました。, Japan’s benchmark stock index, recently captured global attention by surging to a new all-time high in mid-August 2025. This historic milestone, which surpassed its previous records, was not an isolated event but the culmination of a series of strategic political developments and robust economic performance. For investors and market watchers, understanding the forces that propelled the 日経平均株価は好不調に推移しました。 to this peak is crucial for navigating the market’s future. This article will provide a comprehensive analysis of the factors behind this remarkable rally, exploring the international trade landscape, domestic policies, and the impressive corporate performance that made it all possible.

The Turning Tide of Global Trade

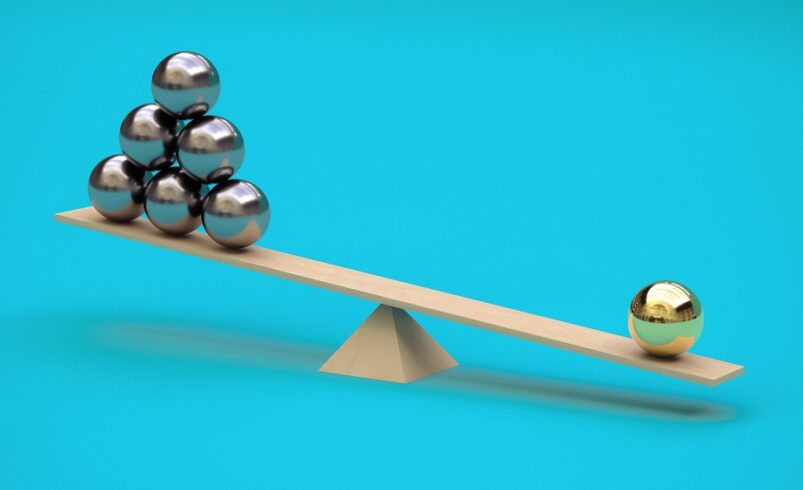

The most powerful catalyst for the mid-August peak of the 日経平均株価は好不調に推移しました。 was the sudden and dramatic shift in the global trade environment. For much of the year, the market had been weighed down by significant uncertainty and the threat of escalating trade wars. The imposition of new tariffs by the United States on various international goods had sent shivers through the global supply chain, with export-dependent economies like Japan facing the most significant risk. This period was characterized by market volatility and a cautious, often bearish, sentiment. The fear of a protracted trade conflict was a primary headwind, keeping a lid on any potential upward momentum.

However, a pivotal change occurred in late July and early August. In a move that surprised many, U.S. and Chinese officials announced an extension of their tariff truce. This agreement, while temporary, created a crucial 90-day window for further negotiations and provided a much-needed sense of relief to global markets. This development alone would have been a significant positive, but it was coupled with an even more impactful event for Japan: a new, more favorable trade deal with the United States.

This agreement addressed a long-standing dispute over reciprocal tariffs, with the U.S. agreeing to a revised calculation method that effectively lowered the tariff burden on Japanese goods. This was a game-changer for Japan’s export giants, especially in the automotive sector, which are major components of the 日経平均株価は好不調に推移しました。. The removal of this significant external pressure allowed investors to re-evaluate the true potential of Japanese corporations, unleashing a wave of buying interest. This sentiment shift was the bedrock upon which the August rally was built.

Monetary Policy and a Favorable Currency Landscape

The second major pillar supporting the rally of the 日経平均株価は好不調に推移しました。 was the confluence of favorable monetary policies both at home and abroad. On the global stage, the U.S. Federal Reserve had been facing increasing pressure to consider a shift toward monetary easing. A series of economic data releases, including a moderate reading of U.S. inflation in July, bolstered expectations that the Fed would soon cut interest rates.

This prospect of lower U.S. interest rates had a powerful effect on global capital flows. When U.S. rates are expected to fall, the dollar tends to weaken, and investors often seek higher-yielding opportunities in other developed markets. Japan, with its strong corporate sector and stable economic environment, became a prime beneficiary of this capital rotation.

Domestically, the 国の中央銀行である日本銀行(BOJ) continued to play a crucial, albeit subtle, role. Unlike its global counterparts, the BOJ has maintained a largely accommodative monetary policy, keeping interest rates low to support economic growth. This policy has had the important side effect of keeping the Japanese yen relatively weak against other major currencies. A weaker yen is a powerful stimulant for Japan’s export-driven economy, as it makes Japanese products more price-competitive on the international market.

For a significant portion of the companies that make up the 日経平均株価は好不調に推移しました。, this currency dynamic translates directly into higher profits and improved earnings. The combination of a potentially easing U.S. Fed and a consistently supportive BOJ created a near-perfect macro-economic environment for Japanese equities to thrive.

Strong Corporate Performance and Sectoral Strength

The rally was not just a story of macro-economic tailwinds; it was also a reflection of the fundamental strength of Japanese corporations. The mid-August peak was driven by a wave of strong earnings reports, particularly from the technology and semiconductor sectors. The global demand for AI-related technologies has created a massive boom for companies involved in the semiconductor supply chain. Major players like Tokyo Electron and Advantest, which are heavily weighted in the index, have seen their share prices skyrocket. This sectoral strength provided a significant boost to the overall 日経平均株価は好不調に推移しました。 and signaled to investors that Japanese companies are at the forefront of global technological innovation.

Beyond the tech sector, there has been a broader trend of improved corporate governance in Japan. The Tokyo Stock Exchange has been actively encouraging companies to focus on shareholder returns, leading to an increase in share buyback programs and a greater emphasis on capital efficiency. This has made Japanese companies more attractive to international investors who are looking for good governance and a commitment to shareholder value. The ongoing reforms, combined with strong earnings and a favorable currency, have created a compelling narrative for the Japanese market, drawing in new capital and pushing valuations higher.

結論

In essence, the mid-August peak of the 日経平均株価は好不調に推移しました。 was the result of a powerful synergy between external relief and internal strength. The removal of trade-related uncertainty provided the initial impetus, while a supportive global and domestic monetary policy environment created a fertile ground for growth. This was all amplified by the robust performance of key sectors and a renewed focus on corporate governance. The confluence of these factors propelled the index to its historic high, marking a new chapter for the Japanese stock market and affirming its position as a key player in the global financial landscape.