For decades, the Japanese financial landscape was characterized by a seemingly contradictory state: immense household savings held predominantly in low-yield cash and bank deposits, while the nation’s institutional investors favored a heavy allocation to Japanese government...Read More

In an era of unprecedented economic shifts and evolving demographics, the concept of wealth management in Japan has never been more relevant. For decades, the Japanese public has been known for its cautious, savings-focused approach to...Read More

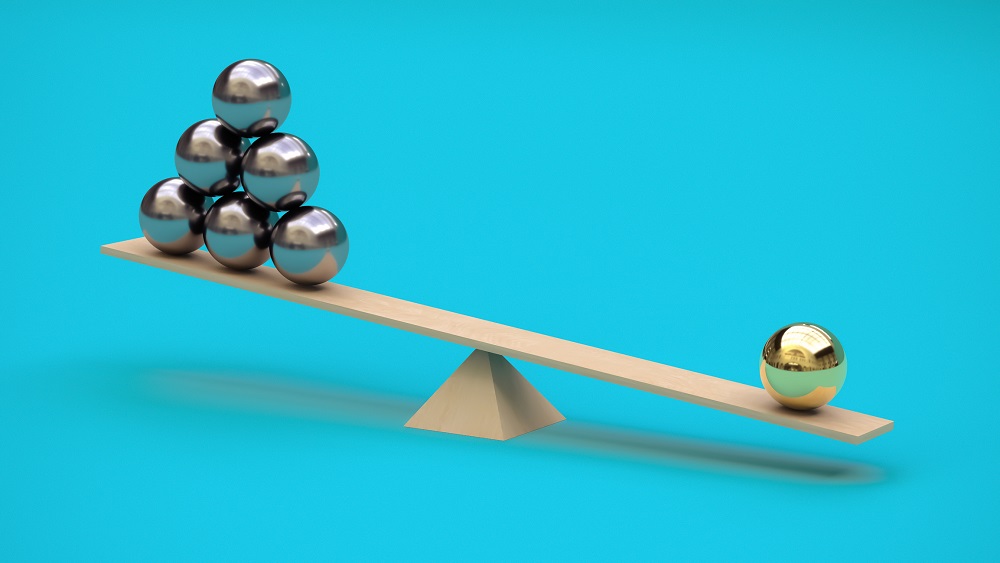

What is a balance sheet? An overview What is a balance sheet? It is one of the most fundamental financial statements, providing a snapshot of a company’s financial health at a specific point in time. It...Read More

The Nikkei 225, Japan’s benchmark stock index, recently captured global attention by surging to a new all-time high in mid-August 2025. This historic milestone, which surpassed its previous records, was not an isolated event but the...Read More

The world of financial trading and technical analysis can often seem daunting, filled with complex jargon and intricate charts. However, one of the most powerful and visually intuitive tools available to traders is the Japanese candlestick...Read More

Embarking on an IPO in Japan is a strategic and transformative decision for any company seeking to access global capital markets and accelerate its growth trajectory. An Initial Public Offering, or IPO, is the process of...Read More

Investing in real estate is a time-tested strategy for building wealth, and for many global investors, Japan presents a uniquely compelling opportunity. The country’s stable political climate, robust legal framework, and a real estate market that...Read More

Are you a foreign resident in Japan looking for smart ways to invest and grow your wealth? You’ve likely heard about the NISA (Nippon Individual Savings Account) program, a powerful tax-advantaged investment vehicle designed to encourage...Read More

In a world of economic uncertainty and fluctuating global markets, investors are constantly seeking reliable assets to protect and grow their wealth. For many, gold has long served as a classic safe-haven, a tangible store of...Read More

For many global investors, the allure of Japan’s dynamic real estate market is undeniable. With its stable economy, advanced infrastructure, and unique cultural appeal, Japan offers a compelling environment for property-related investments. Among the various avenues...Read More