Mastering Wealth Management in Japan: A Detailed Guideline & Top Players in the Market 2025

In an era of unprecedented economic shifts and evolving demographics, the concept of wealth management in Japan has never been more relevant. For decades, the Japanese public has been known for its cautious, savings-focused approach to finances. However, a confluence of factors, including prolonged low-interest rates, a historic shift in government policy, and an aging population, is fundamentally changing this landscape. This comprehensive guide will explore the unique opportunities and challenges of navigating the Japanese financial ecosystem, offering a detailed look at the services, strategies, and key considerations for securing your financial future in the Land of the Rising Sun.

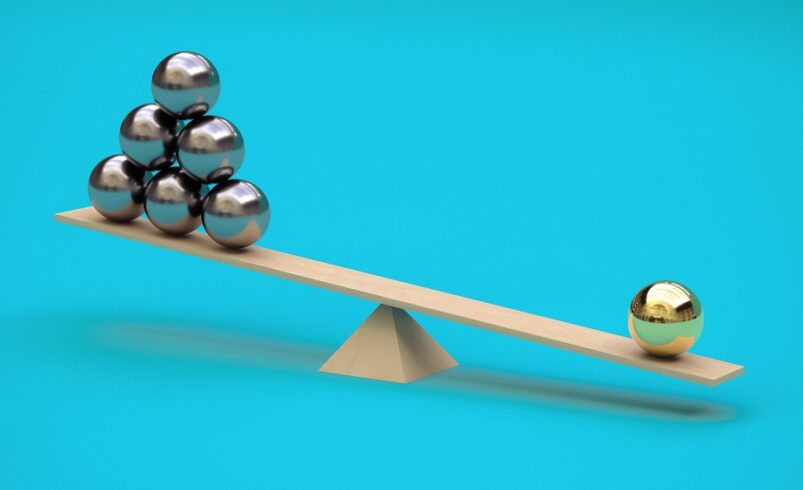

The Changing Financial Landscape: Why Wealth Management is Essential in Japan

The traditional Japanese financial model, centered on cash savings and secure government bonds, is becoming increasingly untenable. Negative real interest rates mean that money in a savings account is effectively losing value over time. At the same time, the government is actively promoting a shift towards investment through initiatives like the expanded Nippon Individual Savings Account (NISA), which offers tax-free growth on investments. This has created a powerful incentive for both seasoned investors and first-time savers to seek expert guidance on how to grow their assets.

Furthermore, Japan’s super-aged society means that a significant portion of the nation’s private wealth is concentrated in the hands of an older generation. This creates a critical need for effective wealth management in Japan to address the complexities of intergenerational wealth transfer, inheritance tax planning, and long-term care financing. The demand for personalized and holistic financial advice is skyrocketing as families grapple with these profound changes.

Understanding the Pillars of Wealth Management in Japan

Wealth management in Japan is far more than just picking stocks; it’s a holistic service designed to manage a client’s entire financial life. A skilled wealth manager acts as a trusted advisor, coordinating a range of services to achieve specific financial goals.

1. Strategic Investment and Portfolio Management

This is the cornerstone of any wealth management strategy. In Japan, this involves navigating a market that has its own unique dynamics, from specific industry leaders to a reliance on domestic economic policies. A good wealth manager will help you build a diversified portfolio that aligns with your risk tolerance and long-term objectives. This might include:

-

Public Equities: Investing in Japanese blue-chip companies, emerging startups, and international stocks.

-

Bonds: Utilizing both domestic government and corporate bonds for stability and income.

-

Real Estate: Japanese real estate remains a significant asset class, and wealth managers can provide expertise in both direct property investment and real estate investment trusts (REITs).

-

Alternative Investments: For qualified investors, this could involve private equity, hedge funds, or venture capital, which offer opportunities for higher returns with a corresponding increase in risk.

2. Comprehensive Financial and Retirement Planning

Planning for the future is paramount, especially in a country with one of the world’s longest life expectancies. A wealth manager will work with you to create a detailed financial plan that addresses your specific life stages. This includes:

-

Retirement Planning: Calculating the funds needed for a comfortable retirement and creating an investment strategy to achieve that goal. This often involves leveraging government programs and private pensions.

-

Education Planning: Saving and investing for children’s or grandchildren’s education, considering the costs of international universities or local private schools.

-

Goal-Based Investing: Tailoring investment strategies to achieve specific milestones, such as buying a second home, starting a new business, or embarking on a passion project.

3. Tax and Estate Planning

Japan’s inheritance tax system is complex and can be very high, making strategic planning a necessity for anyone with significant assets. A key component of wealth management in Japan is the coordination of tax-efficient strategies with legal and tax professionals.

-

Inheritance Tax Optimization: Implementing strategies to legally minimize inheritance tax burdens, such as gifting programs, trusts, and life insurance policies.

-

Business Succession: For entrepreneurs and family business owners, a wealth manager can facilitate a smooth transfer of ownership to the next generation, ensuring the business’s longevity.

-

Cross-Border Planning: Advising on international tax implications for expatriates or Japanese citizens with overseas assets, navigating double taxation treaties and reporting requirements.

The Role of Technology and Digital Transformation

The digital revolution is rapidly transforming how financial services are delivered in Japan. While the traditional model of a face-to-face relationship with a trusted advisor remains dominant, technology is enhancing every aspect of the client experience.

-

Robo-Advisors: These automated platforms offer low-cost, algorithm-driven investment management, making basic financial advice accessible to a broader audience.

-

Hybrid Models: Many firms are adopting a hybrid approach, combining the personalized touch of a human advisor with the efficiency and data-driven insights of digital platforms.

-

Financial Technology (FinTech): Japanese FinTech companies are creating innovative solutions for everything from seamless international transfers to peer-to-peer lending, further expanding the options available for managing wealth.

Choosing the Right Wealth Manager in Japan

Selecting the right partner is a crucial step. The financial services market in Japan is highly competitive, with a mix of large domestic banks, international firms, and boutique advisory practices. When making your choice, consider these critical factors:

-

Credentials and Expertise: Look for advisors with recognized professional qualifications, such as a Chartered Financial Planner (CFP) or Chartered Financial Analyst (CFA).

-

Fiduciary Duty: The most important consideration is finding an advisor who acts as a fiduciary, meaning they are legally obligated to put your interests first. This ensures their recommendations are unbiased and not driven by commissions.

-

Fee Structure: Understand how the advisor is compensated. They might be paid a percentage of assets under management, a fixed fee, or a commission on products sold.

-

Personal Rapport: A strong working relationship is built on trust and clear communication. Choose a wealth manager with whom you feel comfortable discussing your most sensitive financial matters.

Top Wealth Management Players in the Market

The Japanese wealth management market is competitive, with a mix of domestic and international players. Some of the key firms include:

-

Nomura Holdings: A leading financial group with a long history in Japan, Nomura offers a wide range of wealth management and international private banking services.

-

Mitsubishi UFJ Financial Group (MUFG): One of Japan’s megabanks, MUFG is prioritizing wealth management to drive earnings growth.

-

Daiwa Securities Group: Another major Japanese securities firm with a strong presence in the wealth management sector.

-

Morgan Stanley Japan: A prominent international firm that has been a leading player in the Japanese market for decades.

The Future of Wealth Management in Japan

The future of wealth management in Japan is poised for significant growth and innovation. As the country continues its economic transition and its population’s investment literacy grows, the demand for sophisticated and accessible financial advice will only increase. Firms that can successfully blend traditional values of trust and personal relationships with cutting-edge technology and a client-centric approach will be best positioned to succeed.

For individuals and families, the message is clear: proactive financial planning is no longer a luxury but a necessity. The landscape of wealth management in Japan is ripe with opportunities for those who are prepared to navigate it with expert guidance. This dynamic and evolving market offers a path to a more secure and prosperous financial future.